- 1373 reads

Opportunity Zones are a new community development program established by Congress in the Tax Cuts and Jobs Act of 2017 to encourage long-term investments in low-income urban and rural communities nationwide. The Opportunity Zones program provides a tax incentive for investors to re-invest their unrealized capital gains into Opportunity Funds that are dedicated to investing into Opportunity Zones designated by the Governors of every U.S. state.

Opportunity Funds can invest in income-producing real estate located in an Opportunity Zone, such as an apartment complex, shopping center, or office building.

Substantially Improve Real Estate in the Opportunity Zone with LED Lighting:

LED lighting offers Opportunity Zone investors an immediate cost savings with a typical 3-year payback on the investment that improves operating profits, while focusing on sustainable products to “substantially Improve” the property in the Opportunity Zone. Transitioning from incandescent bulbs and florescent tubes and replacing them with LED lighting should be the first step an investor takes as part of the process to substantially improve the real estate.

The following are the seven benefits of LED lighting:

1. Energy Savings

a. LED lights only require about 25% of the energy of incandescent bulbs which results in significant savings in monthly utility bills.

b. An additional benefit will be the reduction of air conditioning expense, as halogen and incandescent bulbs generate heat and are less energy efficient, as LEDs are very cool. According to ASHRAE (American Society of Heating, Refrigeration and Air Conditioning Engineers), their guideline states that 30 to 35 watts of cooling is required to offset the heat output for every 100 watts used to light a space. (https://insights.regencylighting.com/how-to-calculate-hvac-energy-savings-from-lighting-step-by-step-guide)

2. Long Life and Maintenance Savings

a. LEDs have a longer operational life and therefore require less maintenance. For example, a typical T8 fluorescent lamp has a 20,000-rated life and an LED equivalent will have a 70,000 hour rated life.

3. Utility Company Rebates

a. Utility companies offer incentives for businesses to reduce power consumption by switching to LED lighting

b. Here is a great resource to find out what’s available where you live: http://www.dsireusa.org/

4. Better Facility Management

a. LED lighting and controls provide a comfortable and productive visual environment while effectively monitoring energy consumption by controlling the lighting.

5. Instant Lighting and Frequent Switching

a. LEDs can be turned on/off many times as they brighten immediately when powered.

b. Switching LED lighting on/off frequently does not affect their usable life or light emission.

6. Environmental Benefits

a. LED lights are free of toxic chemicals as most conventional fluorescent bulbs contain mercury.

b. Another issue with fluorescent bulb is the disposal as they have traces of mercury and require special care.

c. There is no health risk if an LED happens to break due to the fact it is a solid state object.

7. Improved Quality of Light

a. Employees and customers also experience some health benefits. LEDs don’t flicker like fluorescents can, leading to a more comfortable environment and fewer complaints about headaches or eye strain.

b. LED lighting can improve security and safety with the efficiency, long life and weather resilience by keeping the lights on.

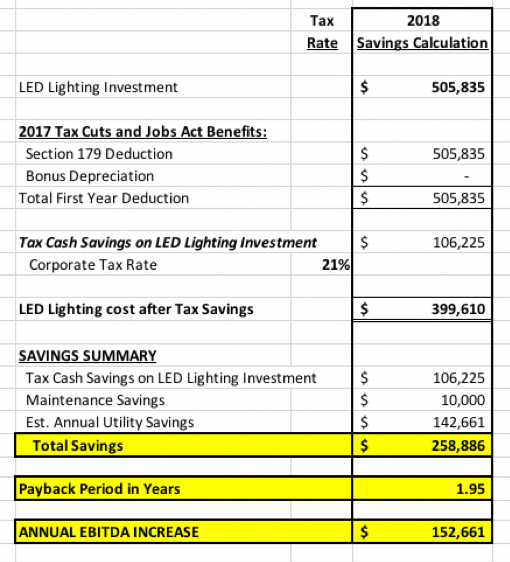

LED Conversion - Case Study

- Summary– This January 2018 project consisted of converting the interior lighting to LED across three buildings on this corporate campus totaling 518,000 square feet. The project involved retrofitting just over 8,094 interior fixtures and during this conversion, about 50% of the interior fixtures were de-lamped from three 32W lamps to two 12W lamps over a 3 ½ week period.

- Utility Savings– reduced total annual kWh usage went from 2,758,461 to 812,350 kWh – a 71% reduction in kWh

- Financial Impact - The annual cost savings went directly to the bottom line improving EBITDA

Conclusion

- Opportunity Zone investments can substantially improve property investments by transitioning from traditional to LED lighting and the cost savings results in improved EBITDA over the investment horizon with the gains being exempted from taxation if held for 10 years.

Opportunity Zone Details:

Under the Opportunity Zone law, the original use of qualifying real estate must commence with the Opportunity Fund, or the property must be substantially improved by the Opportunity Fund. This requirement may not be overly burdensome for new construction and development. However, in low-income, urban communities, the substantial improvement test may be a significant hurdle for real estate projects, notwithstanding the capital-intensive nature of rehabilitating, renovating, or repositioning real estate. The property improvements must exceed the tax basis of the property at the time of acquisition.

There are four primary requirements for a real estate development to achieve the status of “Qualified Opportunity Zone Business Property”:

- The property must be located in a designated Opportunity Zone;

- The property must be tangible property used in a trade or business;

- The property must be acquired by purchase for cash after December 31, 2017; and

- The property must be either (a) new construction that is not put into use until after the purchase of the property; or (b) “substantially improved” after purchase of the property, which requires that the costs of constructing, renovating or expanding the property during any 30-month period beginning after the date of the acquisition of the property must exceed 100% of the adjusted basis of the property at the start of the 30-month period.

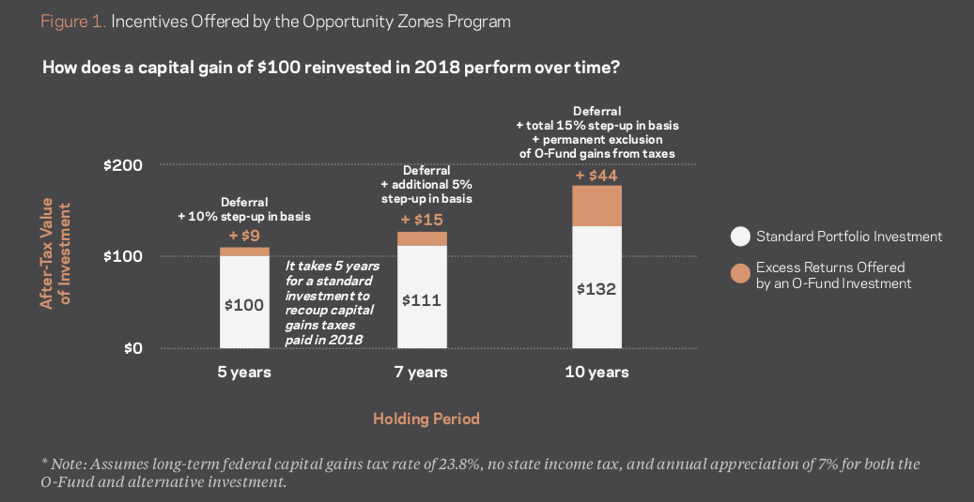

The Opportunity Zones program is designed to incentivize patient capital investments in low-income communities nationwide. All of the underlying incentives relate to the tax treatment of capital gains, and all are tied to the longevity of an investor’s stake in a qualified Opportunity Fund, providing the most upside to those who hold their investment for 10 years or more.

The Opportunity Zones program offers three tax incentives for investing in low-income communities through a qualified Opportunity Fund.

- Temporary Deferral– A temporary deferral of inclusion in taxable income for capital gains reinvested into an Opportunity Fund. The deferred gain must be recognized on the earlier of the date on which the opportunity zone investment is disposed of December 31, 2016

- Step-Up In Basis– A step-up in basis for capital gains reinvested in an Opporunity Fund. The basis is increased by 10% if the investment is the Opportunity Fund is held by the taxpayer for at least 5 years and by an additional 5% if held for at least 7 years, thereby excluding up to 15% of the original gain from taxation.

- Permanent Exclusion– A permanent exclusion from taxable income of capital gains from the sale or exchange of an investment in a Opportunity Fund if the investment is held for at least 10 years. This exclusion only applies to gains accrued after an investment in an Opportunity Fund.

The Opportunity Zones program is designed to incentivize patient capital investments in low-income communities nationwide. All of the underlying incentives relate to the tax treatment of capital gains, and all are tied to the longevity of an investor’s stake in a qualified Opportunity Fund, providing the most upside to those who hold their investment for 10 years or more.

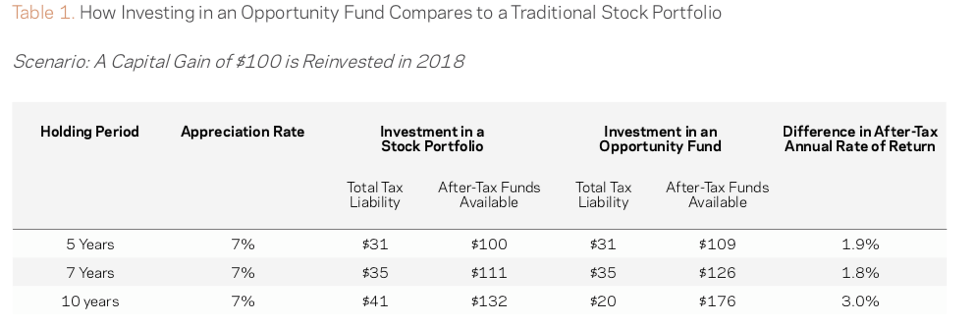

The figure above and table below illustrate how an investor’s available after-tax funds compare under different scenarios, assuming various holding periods, annual investment appreciation of 7%, and a long-term capital gains tax rate of 23.8% (federal capital gains tax of 20% and net investment income tax of 3.8%). For example, after 10 years an investor will see an additional $44 for every $100 of capital gains reinvested into an Opportunity Fund in 2018 compared to an equivalent investment in a more traditional stock portfolio generating the same annual appreciation. Table 1 and the examples that follow provide additional information on the tax liabilities and differences in the after-tax annual rates of return.

About ASG Energy LLC

ASG Energy LLC is a comprehensive LED energy solutions provider with a successful track record of managing energy reduction initiatives and installations for several Fortune 500 companies throughout the U.S. ASG Energy’s energy solutions include LED lighting Air Conditioning Optimization, Solar and Energy Storage. ASG utilizes professional project managers and engineers for all our commercial and industrial customers, medical centers and schools to assist our clients in realizing rapid cost savings, as well as, reducing greenhouse gas emissions and improving facility lighting and safety. For additional information please visit www.asgenergyllc.comor email at info@asgenergyllc.com.

About Revolution Energy Group

Revolution Energy Group was established to provide next generation commercial energy efficiency solutions. Revolution supports public and private sector facility owners and managers who seek high ROI “Energy Intelligence” to reduce operating costs and meet sustainability goals. For more information please visit www.revolutionenergygroup.com. See this link for the optimization beyond HVAC Optimization

Tax, Legal or Accounting Disclosure

ASG Energy and Revolution Energy Group do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

To ensure compliance with requirements imposed by the IRS, we inform you that any U.S. tax advice contained in this communication which includes any attachments, is not intended or written to be used, and cannot be used, for the purpose of avoiding penalties under the Internal Revenue Code or promoting, marketing, or recommending to another party any transaction or matter addressed herein.[IRS CIRCULAR 230 DISCLOSURE]